Mining Journal Intelligence

Investor Sentiment Report

How will mining investments fare in 2023?

Mining investors bullish for 2023

The bulk of mining investors expect a positive shift in 2023, following a lacklustre performance by the industry last year.

And investors are increasingly targeting exposure to battery, rare earth and fertiliser minerals, as well as the traditional priorities of base and precious metals, according to Mining Journal Intelligence’s (MJI) Investor Sentiment Report 2023.

The report – which has this year been spun out from MJI’s former Global Finance Report, of which it previously formed a chapter – is based on a survey of almost 100 investors with combined assets under management (AUM) of about US$7 billion.

As in previous years, survey questions focused on the scale and performance of mining investments, as well as preferences, including favoured (or avoided) commodities, geography, and project stage (exploration, development, or production), as well as the critical factors on which investment decisions are based. Results were broken down by investor type (institutional versus retail) and by investors’ total AUM to provide additional detail.

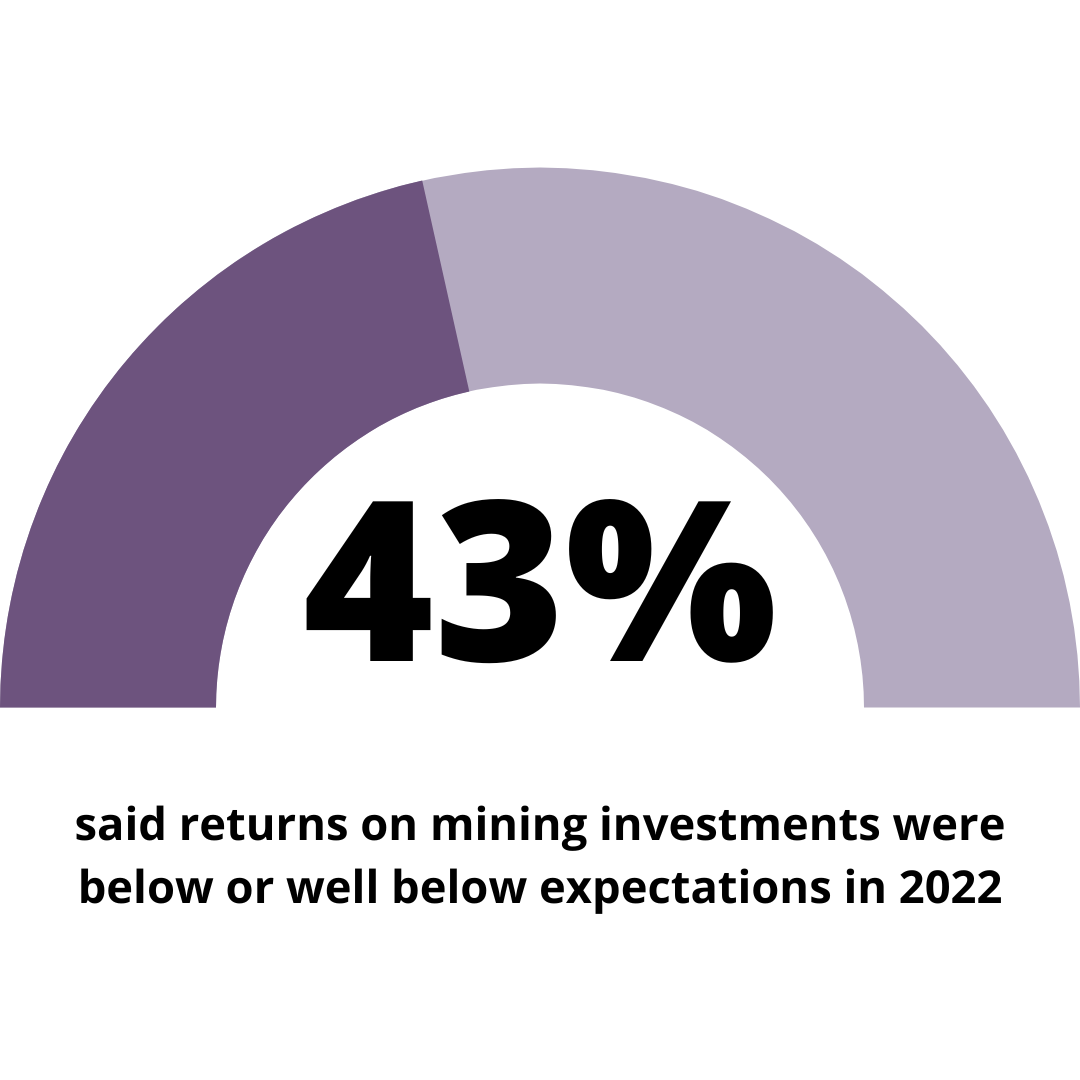

Among the key findings, 43.5% of all respondents said their mining investments had fallen below or well below expectations in 2022 – the highest percentage since 2018, reflecting the general decline in share price performance amid soaring inflation and interest rates and geopolitical tensions in the wake of Russia’s invasion of Ukraine.

But 60.9% expect mining investments to perform better in 2023 against a backdrop of growing demand.

“The big driver is the electrification of energy systems, wind farms, solar farms, electric vehicles, all of that. That’s going to help lift demand for commodities,” SP Angel’s John Meyer told MJI.

Base metals remained the top focus for new investments, but battery minerals rose through the rankings to second, targeted by 76.1% of investors, up from 48.6% last year.

In terms of geography, traditional safe-haven jurisdictions remained popular, with Australia at the top of the pile, targeted by 72.8% of respondents, up from 47.0% last year.

For research enquiries or commentary, please contact Sam Williams, editor, Mining Journal Intelligence: sam.williams@aspermontmedia.com

For subscription enquiries, please contact: +44 (0) 208 187 2299 or +61 8 6263 9100

MINING JOURNAL GLOBAL FINANCE SERIES

A critical review of mining's key global stock exchanges, the results of our investor sentiment survey; and insights from the alternative financing community.

INVESTOR SENTIMENT REPORT

Survey revealing mining investors’ plans and priorities – and how their investments are performing.

MINING EQUITIES REPORT

Quarterly mining IPOs and secondary raisings data and mining equities performance tables with an annual Stock Exchange Comparisons supplement.

COMING SOON!

ALTERNATIVE FINANCE REPORT

Analysis of the evolving role of alternative finance in mining including opportunities, deals volume and the performance of royalty/streaming equities.

MiningNews.Net Premium Subscribers can read the full Mining Journal Intelligence Global Finance series online.

If you'd like to subscribe or upgrade to a Premium Subscription, click the button below or contact the team at subscriptions@aspermont.com or at +44 (0) 208 187 2299.

Copyright © 2000-2023 Aspermont Ltd. All rights reserved. Aspermont Limited (ABN 66 000 375 048), PO Box 78, Leederville, Western Australia 6902