MiningNews.net Research Report 2024

What are the highest and lowest-risk Australian states for mining investments?

of Australia-focused investors expect a better performance in mining in 2024

Australia/Oceania’s average Investment Risk Index score, equating to lower moderate risk

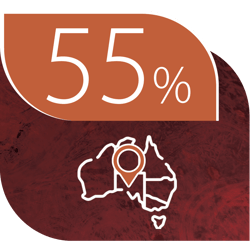

of global investors are targeting new investments in Australia

this year

As far as years go 2023 was not an annus horribilis for Australian miners. It may have felt that way for some, but the Australian Securities Exchange (ASX) held up reasonably well – and investors are optimistic about 2024.

Mining risk in Australia/Oceania remains stable in 2024, despite a global shift higher – but the region is outclassed by its North American rivals in investment attractiveness, according to the MiningNews.net Research Report 2024 (MNN 2024).

The report, by Aspermont research division Mining Journal Intelligence (MJI), shows the Australia/Oceania region’s average risk held steady, rated as ‘lower moderate risk’ – but Canada and the US consolidated their positions as global leaders on the risk front.

Canada also replaced Australia as the top-pick country for new mining investments in MJI’s Investor Sentiment Survey 2024.

The MNN 2024 report provides a multi-pronged tool to help mining professionals and investors identify opportunities and risks in Australia and nearby geographies, taking a deep dive into five critical themes: top projects, C-suite priorities, risk, investor sentiment, and financing.

Findings are sourced from MJI’s World Risk, Project Pipeline, Global Leadership, Investor Sentiment and Mining Equities reports, with data updated and refocused to shed light on conditions in Australia’s mining sector in 2024.

While Australia/Oceania have more work to do if they are to close the gap on North America, there was some positive news on the investment front for 2024. Although most Australia-focused investors (66%) were disappointed by the mining industry’s performance last year, about seven-in-10 (69%) expect improved returns on their mining investments this year.

In the Project Pipeline Assets section, MNN 2024 identifies Australia’s most attractive development projects, based on our unique ranking methodology, with Liontown Resources’ Kathleen Valley lithium asset taking the top spot.

The Global Leadership section presents CEOs’ views on the rising challenges around social licence, and their strategies for improving community relations.

MiningNews.Net Premium Subscribers can read the full Research Report 2024 online.

For research enquiries or commentary, please contact Sam Williams, editor, MiningNews.Net: sam.williams@aspermont.com

If you'd like to subscribe or upgrade to a Premium Subscription, click the button below or contact the team at subscriptions@aspermont.com or at +61 8 6263 9100.

Copyright © 2000-2023 Aspermont Ltd. All rights reserved. Aspermont Limited (ABN 66 000 375 048), PO Box 78, Leederville, Western Australia 6902